I had recently visited London on a business trip. I took advantage of schedule-free weekend and made a pilgrimage to Harrods: some would say it’s a truly British institution. Harrods is London’s upmarket department store which prides itself on its motto ‘Omnia Omnibus Ubique’ which is Latin for ‘All Things for All People, everywhere’ (what an irony!).

In the spirit of tradition, I picked up Harrods’ loose-leaf tea – to be exact, No. 14 and No. 42 – for my family. And as the light of Ramadan is fast approaching, I also procured some shortbread and fudge milk chocolate biscuits as well as assorted dates for friends.

"66 Omnia Omnibus Ubique' which is Latin for 'All Things for All People, everywhere' ' (what an irony!) 29"

The city was back at its feet and shoppers flooded Brompton Road in Knightsbridge that sunny Saturday morning. There were men and women, of various ages, along that busy street and in the corridors of Harrods. I noticed there was a group of middle-aged activists, protesting on that busy shopping street. I had initially thought they were reminding public to mask up although British government publicly declared that UK is transitioning from Covid-19 pandemic to endemic state. Instead, the protestors were expressing their rejection of the masses snapping up shopping baskets and bags. They chanted ‘Stop Buying, Start Living!’.

I have a different view: we are in the state of denial about shopping. A longstanding practice of scholarly snootiness toward the consumerism has constructed an austere cheerless vision about as close to retail reality as Ptolemy’s flawed geocentric model.

Consumerism is not necessarily bad although Google’s dictionary labels the term as ‘often derogatory’. Increased sales encourage businesses to invest. Economic growth requires expanded production and higher earnings, and for some economies, their growth potential anchors in robust consumer market. Money is central to consumerism. Money finances consumption, and consumption expands economy, which in turn grows wealth and money. We often condemn wealth creation when the actual issue is inequal distribution.

Rather than seeing shopping as an empty and somewhat desperate act of self-centred indulgence, I often view it as ritual act of love. It is a munificent act or a generous acknowledgement of the value and reality in personal interests beyond our own. It does not deserve its bad reputation – whether the bad rap stems from suspicion of capitalism or prejudiced dismissal of the pursuit as trivial indulgence.

My point is it is not necessarily a materialistic dead end. It can be a genuine expression and acknowledgement of devotion and appreciation. Our souls do not necessarily empty out along with our pockets. Shopping and buying gifts for family and friends are an act of esteemed adoration and an expression of ecstatic merriment that are sacrificially other-centred. It celebrates the bounty of an expressive public devoted to the pursuit of love.

As we usher in Ramadan and prepare for Eid or Hari Raya celebration, the team has come out with Changing Consumerism issue for this month’s newsletter. One of the most important changes that came as a result of Covid-19 is that we have become more appreciative of our family and friends. We are increasingly mindful of the importance to help less privileged. This in turn has led to a major shift in how we approach gift- and alms-giving. The rise in household consumption – food and beverages in particular – will drive up traffic to e-commerce marketplaces and online purchases. Data-driven marketing strategy that seeks to maximise customer’s value, increased e-retail options as well as payment methods such as Buy Now, Pay Later (BNPL), faster internet speed and quick delivery service are making it easier for us to shop.

Let’s keep the Ramadan spirit alive and show our appreciation to our loved ones and others in our community who have suffered through difficult times. Spread peace, show love.

Catalyst for the Internet Economy

The Covid-19 pandemic brought upon a plethora of disruptions to the world. From a business perspective, we saw how the pandemic accelerated the digitalisation of end-to-end business processes as companies had to adapt to the new normal. Various aspects of businesses including supply chain management, employee working arrangements, bookkeeping, payment processing and many more had to be revisited as lockdown and movement control orders were imposed to contain the spread of the virus. Nonetheless, little is said about the variable on the other side of the equation: the end consumers.

Crisis breeds ingenuity. With strict containment measures, features such as contactless delivery and payment became mainstream. Traditional brick-and-mortar businesses, desperate for survival, had to provide consumers with online touchpoints, paving the way for a booming internet economy.

Changes in Consumer Behaviour

The pandemic has fundamentally changed what consumers seek, in line with higher digital adoption and penetration. While it is almost impossible to narrow the shift in consumer behaviour to a single pillar, the sector that has seen strong traction is e-commerce or online shopping. During the height of the pandemic and before vaccines were mass-produced, containment measures limited consumers to stay-at-home arrangements. Even when brick-and-mortar stores were open, containment measures such as social distancing and hygiene awareness heightened demand for online shopping.

But is e-commerce adoption merely a fad brought on by the pandemic? Or is it really a permanent shift in behaviour? Covid-19 has in a way “forced” consumers to embrace e-commerce and online shopping as a way to suppress the spread of the virus, but the significantly higher perceived convenience alongside other benefits may make the behaviour permanent. What started as a safety measure has eventually turned out to be the catalyst for consumer behavioural change as consumers start to enjoy non-health benefits such as convenience, time savings and wider product ranges. Demand for online shopping could very well be sustainable for the long term.

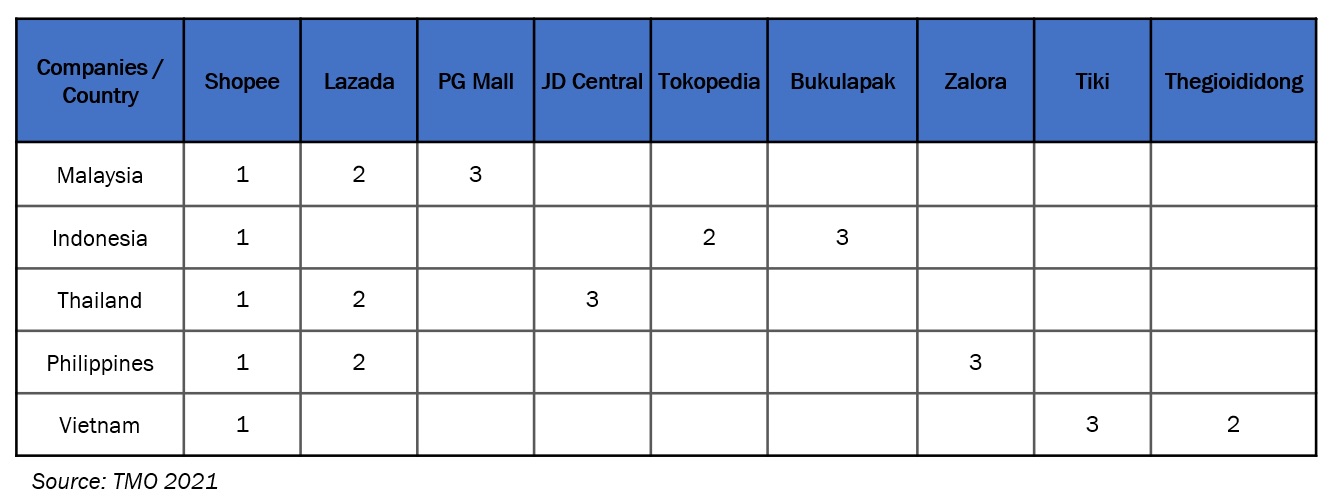

Top 3 most popular e-commerce platforms in Southeast Asia

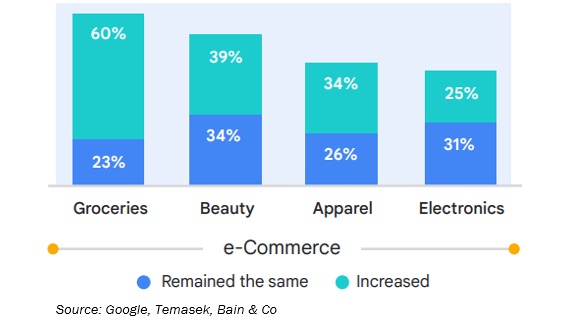

% split of users by how spending has changed vs. pre-COVID

A growth area under e-commerce that is particularly worth mentioning is online grocery. For consumers, grocery shopping can be a hassle – they often make infrequent trips and prefer to stock up instead to save time. However, perishables or food that have short lifespans no thanks to expiration dates often end up in the bin, creating mass amounts of food wastages. Online grocery shopping addresses this issue by providing consumers with the convenience of simply ordering in smaller batches, or in other words, only ordering what they will consume. This is further helped by the development in Just-in-Time deliveries for consumers. As a result, grocery shoppers can better manage their needs and thereby eliminate waste.

Businesses and start-ups have responded to this shift by striving to meet the demands and needs of the consumers, creating a more positive buying experience which creates stickiness even after the pandemic is long gone (of course, it remains to be seen if Covid-19 will end but one can dream!). This paved the way for another sector vertical to complement the consumer behaviour shift amid the pandemic: Buy Now, Pay Later (BNPL).

The rise in BNPL adoption was a boon especially at the height of the pandemic. Struggling consumers had cash flow difficulties because of massive unemployment due to companies cutting cost and downsizing their workforce in response to slowing economic activities. But BNPL introduced consumers to the idea of lessening the impact of purchases (especially sizable ones) on their cash reserves and provided a lifeline for those who were struggling to make ends meet.

Enterprise Innovation Driven by the Change in Consumer Behavior

The change of consumer behaviour has also changed the behaviour of businesses that serve them to reflect the times. Most merchants have adopted technology in the wake of lockdowns and border closures to ensure their business continuity. Three focus areas of these technological adoption are digital platforms to engage with suppliers and customers, financial services to facilitate cashless transactions and access credit and digital tools which offer solution to enhance operations and productivity.

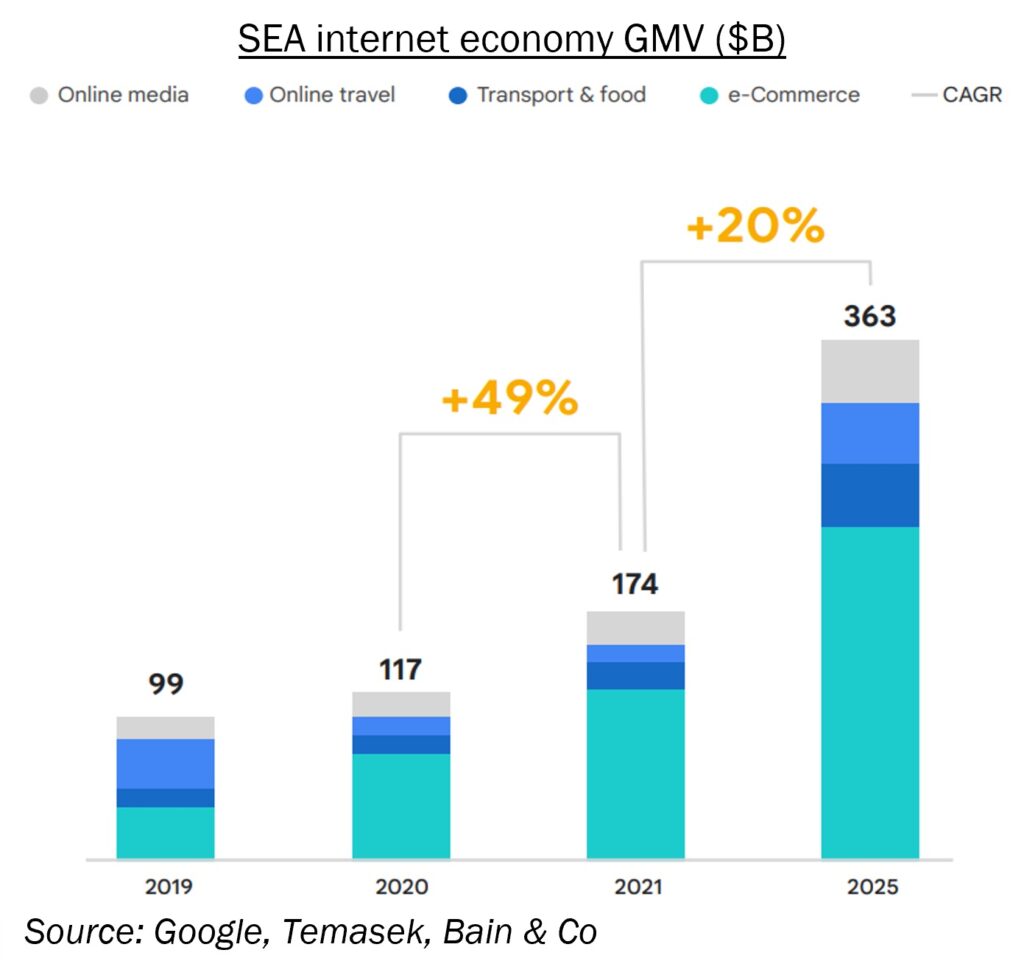

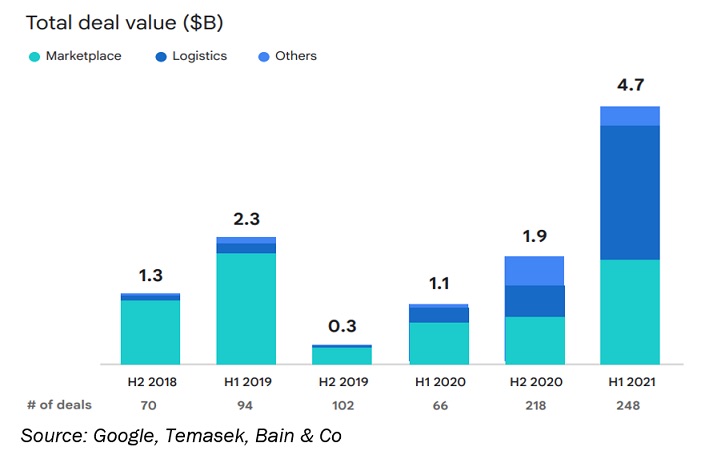

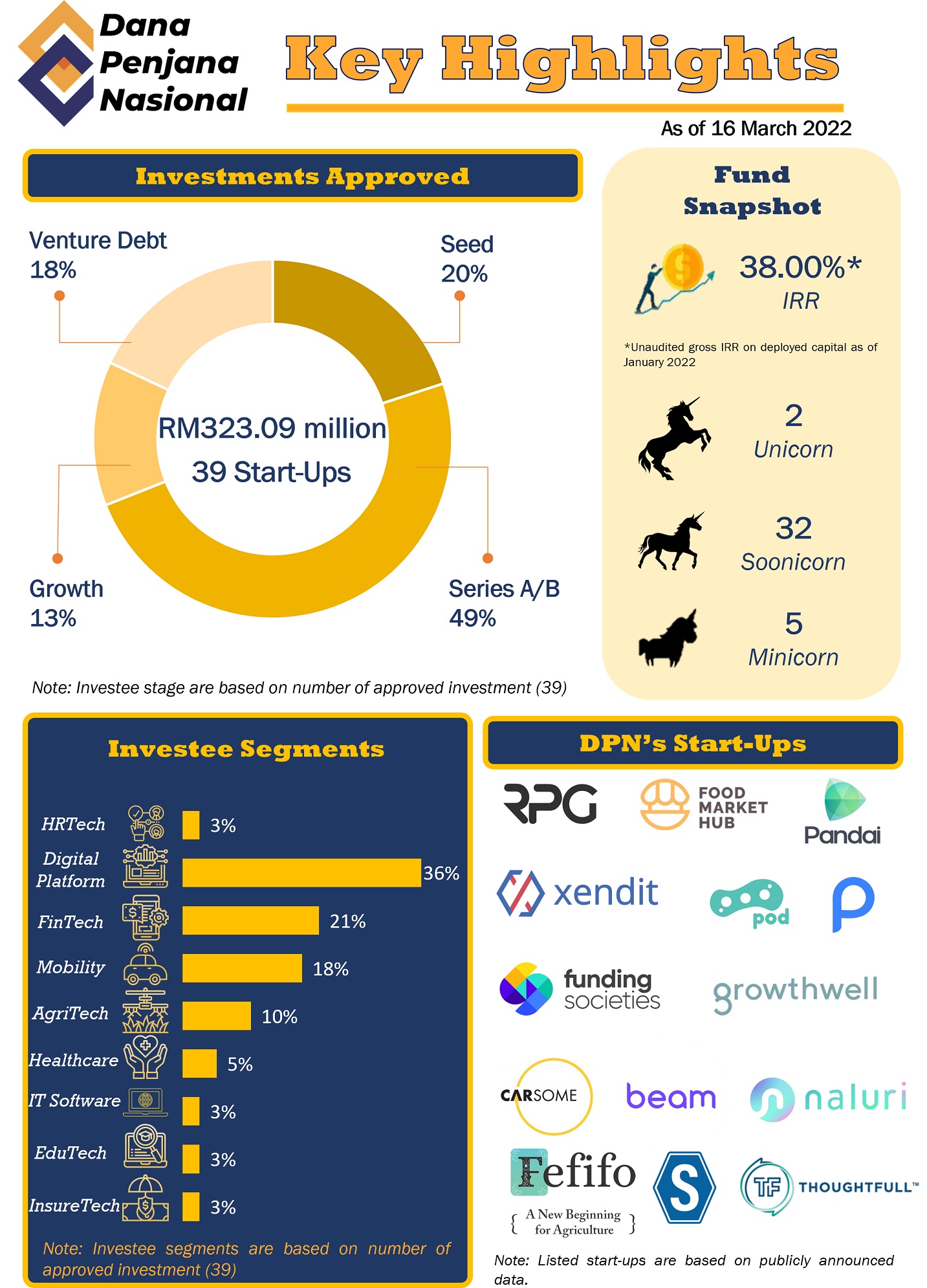

The boom of the demand of digital adoption has also increased the value of many businesses in the three areas of digital platforms, fintech and digital tools. 11 of the newly minted unicorns in the Southeast Asia region for the year 2021 are consumer technology companies. Start-ups such as J&T Express, Carsome and BliBli turned unicorn in 2021 on the back of demand for e-commerce. Moving forward, the internet economy in Southeast Asia will particularly be driven by the consumer and merchant behaviours which would catapult it to a USD1 Trillion Gross Merchandise Value(GMV) economy as predicted by Google, Bain and Temasek in its e-Conomy SEA 2021 report.

Success Factors in Driving a Thriving Internet Economy

With the emergence of new business models such as BNPL which enables consumers to purchase items with credit similar to credit cards, it is inevitable that this space will be regulated eventually. Regulation remains as a success factor as the approach for regulation will determine the way the businesses conduct themselves and eventually this will also influence consumer behaviour. Bank Negara Malaysia (BNM) for example has announced that the Bank is driving inter-agency efforts to strengthen regulatory arrangements for all consumer credit activities including providers of BNPL schemes. Similarly, Monetary Authority of Singapore (MAS) has also announced that it is working on new guidelines on BNPL services are being developed to safeguard consumer interests of Singaporeans.

Aside from regulation, availability of talent is important to support the growth of the internet economy. As doing business online become the norm in the next decade, digital infrastructure becomes more complex and maintaining these infrastructures would not only require technology but also manpower to work in these increasingly complex business environment. Post Covid-19, we have seen governments and the business community actively investing in talent development and upskilling initiatives. This is also supported by the boom in Edtech which sees further investments to alleviate the talent shortage problems and to build a continuous pipeline for the internet economy.

Pictured: Almost every winning artwork about Wawasan 2020 (Vision 2020) in Primary & High School circa: 1991 – 2010

2020: Flying Cars, Soaring Wealth

Like many Malaysians, the Year 2020 conjures up images of flying cars, giant mega-cities with cutting edge technology – Vision 2020 as first mooted in 1991. Although manufacturing flying cars were not part of Malaysia’s Vision 2020, it’s us – the millennials – who forcefully bend the vision to include aerocars (after binging on our Saturday cartoons).

Fast forward to 2020, the Covid-19 pandemic swarmed traditional business landscape. No cars were seen soaring through the sky, we have instead e-Commerce flying high; its impact so dominant that it necessitates businesses to have an online presence just to survive. Thus, when Malaysia executes its first and strictest movement control order (MCO), e-Commerce exploded. Businesses with online platform thrived, while others struggled to survive. Which brings us to the start-up of the month.

HappyFresh (“iCart Group Pte Ltd”) is grocery delivery service provider operating in Malaysia, Thailand and Indonesia. They offer 3 distinct services (1) B2C e-Grocery, (2) B2B e-Grocery and (3) Ads Services.

e-Grocery: Convenience On-Demand

The Covid-19 pandemic has undoubtably changed our way of life. Prior to the March 2020 lockdown, many Bachelors of Single & Available such as myself survived on diet known as intermittent mamak. During the lockdown however, I find myself standing cluelessly at my local grocer scouring for ingredients listed in an online recipe for Dishoom’s Chicken Ruby (highly recommended). Aside from the fact that grocery shopping is not as enjoyable as Christmas shopping, it is also time consuming.

From traveling, queuing to unpacking, a typical grocery run takes up at least 2 hours of my time weekly and I was only feeding myself. Now imagine working professionals living in household with 5 mouths to feed. Imagine now a frontliner living in a household with 5 mouths to feed.

This is where HappyFresh comes in, providing convenience on-demand so working professionals can focus on work, so frontliners can rest easy and focus on saving as many lives as possible. If this seems like an advert for HappyFresh, rest assured it is not (Unless you use promocode @JoeC88 during checkout)1.

1. Disclaimer: This is obviously just a joke.

Value Proposition

HappyFresh boasts a 3-pronged value proposition to (1) Consumers, (2) Retailers, and (3) Brands

|

Consumers

|

Retailers

|

Brands

|

|---|---|---|

|

|

|

- Customers can place orders either through HappyFresh’s website or mobile application. A trained personal shopper will be assigned to the order and customers can track their orders in real time. The company is committed to complete delivery within an hour.

- Retailers and brands on the other hand gain extra insights from the data collected by HappyFresh whilst benefiting operationally from functions such as real time stock tracking. The data, under the right hands can help retailers and brands predict and prepare for trends.

Low Barrier of Entry: Market Saturation

The idea of online grocery is not new. In actuality, some of the bigger players such as Tesco have experimented and launched their own e-Grocery in other countries they operate in.

On the local front, once the idea floats around; it is just a matter of time where giants such as Grab Mart and Jaya Grocer enter the fray. As of today, e-Grocery is so prevalent – even e-Commerce platform such as Shopee offers the service.

Value Proposition vs Unit Economics

Similarly, the concept of online grocery aggregator is not exactly novel. For instance, HappyFresh, shares similarities with Singapore’s Honest Bee. Both rely heavily on trained personal shoppers handpicking and packing manually from diverse non-standardized merchants. Today, HonestBee is a case study, often cited as an example of value proposition not scaling due to dysfunctional unit economics. There is a stark difference in efficacy of picking and packing manually versus packing from a fully automated fulfilment center. Its competitor, took notice earlier – set up fulfillment centers to drive efficiency and subsequently their key metrics.

TL:DR

Long story short, amid market oversaturation as well as the importance of automated fulfilment centres, it is crucial for HappyFresh to be one step ahead of the herd – through strategic partnerships and well thought out expansion plans; especially in Malaysia. Which is exactly what they did.

As of the writing of this paper, HappyFresh has set up their own fulfilment centres across Klang Valley to improve their unit economics. Meanwhile, the company began hiring aggressively – with plans to double the headcount of gig workers to scale operations. By year end 2022, the company expects total headcount in Malaysia to hit 700-1000, whilst forging key partnership and contracts with local FMCG suppliers, logistics, marketing, advertising and et cetera.

The company could potentially have synergistic or collaborative values with some of our other investees under Dana Penjana Nasional (DPN). This is especially distinct with our Fintech investees who offer services such as Buy-Now-Pay-Later (BNPL) or Earned Wage Access (EWA).

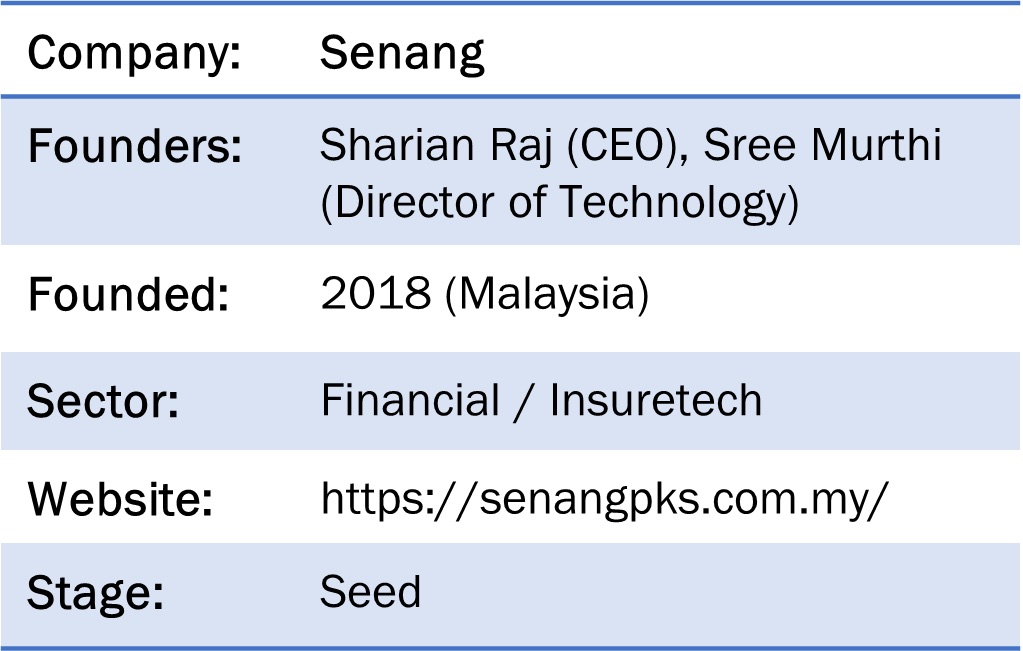

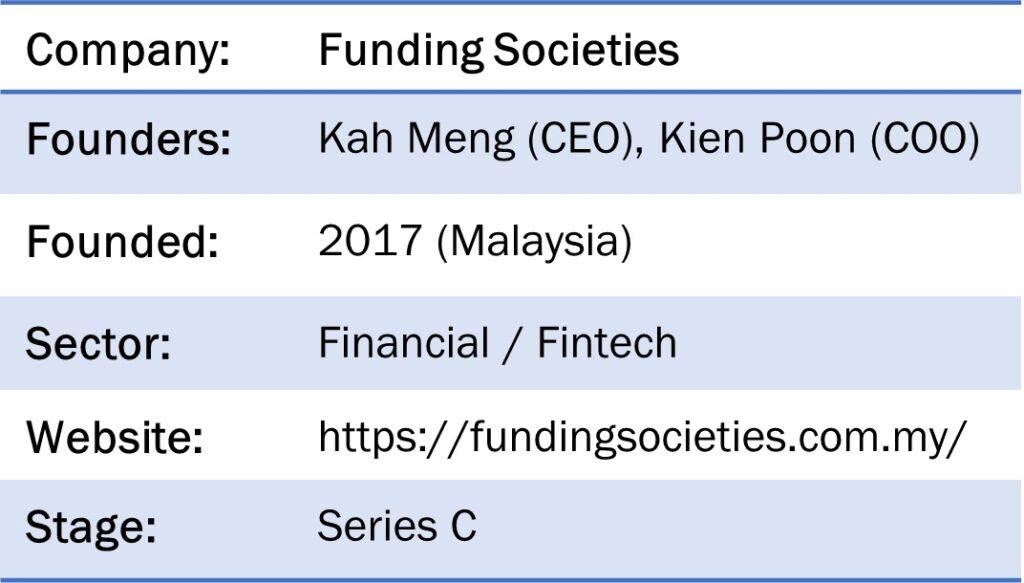

Capital Connections 4.0 – Featuring Pod, Payd, Senang and Funding Societies Malaysia

We love it and judging by the RSVP list, so do our esteemed guests. Therefore, to keep the momentum going, Capital Connections 4.0 was held on 11th of March 2022.

This time, we are featuring not just 1 start-up but 4 Fintech Start-up and co-hosted by our valued VC partners, The HIVE Southeast Asia, Iris Capital Partners and Hanwha Asset Management

and Hanwha Asset Management

Opening speech by Assistant Governor of BNM En. Adnan Zaylani bin Mohamad Zahid

Moderated by Dato’ Syed Haizam Jamalullail

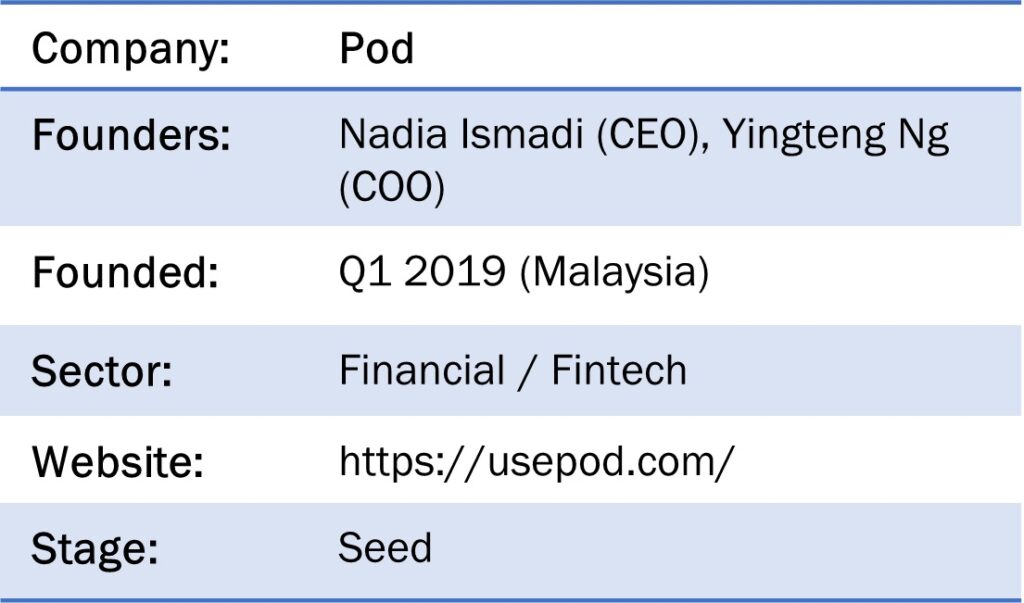

Pod is a financial wellbeing platform where, through digital tool and analytic solution, Pod assist users to save towards their financial goals and build-up credit score. At Pod App, users can perform and track their savings progress as well as to gain access to affordable micro-financing products. Pod also works very closely with gig-platform such as GoGet, ShopeeFood and Foodpanda to help gig-workers with their savings and their needs for financing.

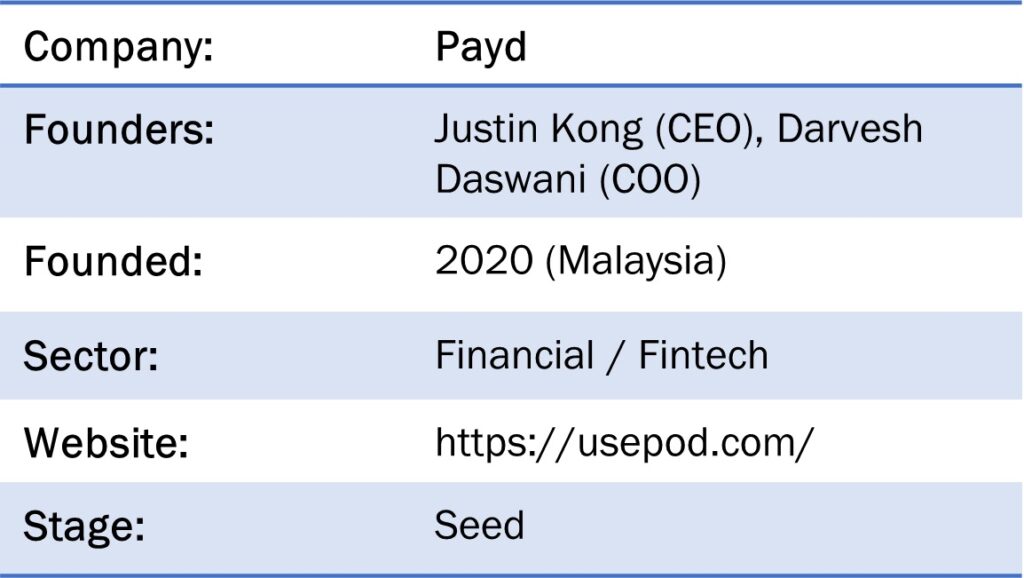

Co-founded in 2020 by Justin Kong and Darvesh Daswani, Payd is a B2B platform that allows employers to give their employees the company benefit of Earned Wage Access (EWA). This enables employees to receive a portion of their salary as they earn it without the embarrassment of asking for salary advances, borrowing from family and friends, or going through payday lenders. With Payd, employees can access up to 50% of their income whenever they need it. Payd is on a mission to build the largest mobile financial wellbeing platform for employees in Southeast Asia.

For employers, the Payd platform provides a proven benefit that drives employee engagement, productivity and retention by reducing their financial stress. Employers will be able to contribute to the financial wellness of their staff, and improve the employee experience within their organization without the need to add costly new programs and initiatives to the budget, by offering the benefit of EWA.

Established in 2018, Senang is an InsureTech organization that enables low to middle-income customers to purchase insurance for the first time via bite-sized microinsurance. As the namesake goes, ‘Senang’, they pave the way for corporate, start-up companies, micro, small, and medium-sized enterprises (MSMEs), and even individuals to obtain one-off insurance coverage ensuring that they only pay for what they need at that point in time. The platform was developed and designed to streamline the process of buying insurance as well as claiming from insurance hassle-free. This segment is not prioritized by large insurance companies, and they would not offer coverage as low as 1 Ringgit ($0.20) directly. Thus, Senang plays a broker role between the large insurance providers and those who need micro-coverage and leverages technology to make it work between the three parties. Senang aims to have all lines deterring people from having access to insurance that is hassle-free blurred, if not completely erased.

Senang was co-founded by Sharian Raj and Sree Murthi.

Launched in 2017, Funding Societies Malaysia is the first and largest SME digital financing platform in Malaysia. Registered with the Securities Commission, the digital financing platform connects SMEs with investors through an online marketplace, thereby increasing access to financing for SMEs. The fintech platform provides business financing to small and medium-sized enterprises (SMEs), which is funded by individual and institutional investors. By investing into SMEs, investors could earn risk-adjusted returns. Meanwhile, SMEs obtain access to short-term financing to expand their business through a fast and simple online process. Additionally, SMEs benefit from not having to provide collateral for financing, while interest costs are minimized due to short financing tenures. Funding Societies is also present in Singapore, Indonesia (where it is known as Modalku), Thailand, and Vietnam thus emerging as one of the largest digital financing platforms in Southeast Asia. In seven years, it has helped finance over 5 million business deals with almost RM9 billion in funding.

| DISCLOSURES AND DISCLAIMER |

This Newsletter is strictly informational and is issued Penjana Kapital Sdn Bhd (“PKSB”) on the basis that it is only for the information of the particular person to whom it was provided. This document may not be copied, reproduced, distributed or published by any recipient for any purpose unless Penjana Kapital Sdn Bhd’s prior written consent is obtained. This newsletter has been prepared for information purposes only and is not intended as an offer to sell or a solicitation to buy any securities, and/or any other product in Public or Private markets. Penjana Kapital Sdn Bhd is not making any recommendation to buy any securities or other product and the information provided should not be taken as investment advice.

It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Penjana Kapital Sdn Bhd has no obligation to update its opinion or the information in this newsletter and Penjana Kapital Sdn Bhd recommends that you independently evaluate particular investments and strategies and seek the advice of a financial adviser prior to entering into any transaction. The appropriateness of a particular investment or strategy will depend on your individual circumstances and objectives. The information herein was obtained or derived from sources that Penjana Kapital Sdn Bhd believes are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions and estimates included in this newsletter constitute our views as of this date and are subject to change without notice.

Penjana Kapital Sdn Bhd is not acting as your advisor and does not owe any fiduciary duties to you in connection with this newsletter and no reliance may be placed on Penjana Kapital Sdn Bhd for advice or recommendations of any sort. Nothing in this newsletter shall constitute legal, accounting or tax advice, or a representation that any transaction or investment is appropriate for you taking into account your investment objectives, financial situation and particular needs, or otherwise constitutes any such advice to you. Penjana Kapital Sdn Bhd makes no representations or warranties, express or implied, with respect to the accuracy of the information or fitness for any particular purpose and does not accept any liability (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) for any use you or your advisors make of the contents of this newsletter or for any loss that may arise from the use of this newsletter or reliance by any person upon such information or opinions provided in the newsletter. This newsletter has been prepared by the analysts of Penjana Kapital Sdn Bhd. Facts and views presented in this newsletter may not reflect the views of or information known to other business units within Penjana Kapital Sdn Bhd. This information herein is not intended to constitute “research” as it is defined by applicable laws. This newsletter is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information provided in this document has been obtained or derived from sources believed to be reliable. Penjana Kapital Sdn Bhd does not guarantee its accuracy or completeness and does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinion. Such information or opinions are subject to change without notice, are for general information only and is not intended as an offer to sell or a recommendation/ solicitation to buy any securities, foreign exchange or other product.