An informal partner ecosystem network, dubbed as MyTED which includes Penjana Kapital, recently hosted a roundtable. Amid the pleasant industry chatter and coffee, an odd question cropped up. “How do you stay positive?”. It came from an institutional investor. She was puzzled by my posture against a backdrop of uncertainty, doom-mongering and dour outlook – the economy, the energy, the environment, you name it. In answer to her question, I think there is plenty to be upbeat about. The purpose of venture capital is to look beyond short-term cycle, and I keep reminding myself that we are investing in innovation and for the long-term. We look beyond the headlines to find fresh ideas and solutions that nudge the world towards more nuanced and nicer outcomes. We pride ourselves on embodying our motto “no great idea goes unfunded”.

As temperatures soar and the cost of living continues to rise, governments scramble to hire their own chief heat officer. In the UK, the newly created post is called director-general of winter resilience. Jonathan Mills was recently appointed to the post and his immediate priority is to ensure that the country does not bear the brunt of looming energy-supply issues this summer and in the winter. That means managing the rise in costs, making sure that people can keep their homes cool in hot weather and heat their homes in the colder months and avoiding power cuts. My British friends have complained that their summer evenings are too warm, leaving them sleepless in the heat. And most Malaysians who went to school or worked in the UK would know that it is not easy to reach for air conditioning. Just 1% of the buildings in the country have fixed cooling systems, and a further 3-5% have portable cooling systems. That is likely to change as summers get warmer.

By 2035, it’s reported around 20% of London homes will require air conditioning. That is a lot of new AC units. These will use huge amounts of electricity, far more than any other appliances in the house, and they will have an emissions impact to match. As the UK embarks on its air conditioning spending spree, it mirrors a transition that is already under way in much hotter places. In Malaysia and other emerging Asia, AC demand is soaring as incomes rise. Owning an AC unit can be life-changing for us living in tropical climate. By 2050, two-thirds of the world’s households will have an AC. Collectively, this will have a gigantic impact on our energy use. AC and fans already account for around 10% of the world’s electricity consumption. And they are particularly challenging for electricity grids because demand surges on hot days and often threatening the network stability if the grid cannot keep up. All these new AC units currently being bought will also have an emission impact namely from the carbon dioxide produced by the electricity grid (unless it is all clean power). Yet as the planet gets warmer, more AC will be necessary to sustain human life especially in the world’s hottest places, driving a vicious cycle. Access to air conditioning exacerbates the inequality at the root of climate change. People who are poor produce the least emissions, yet they are also the most exposed to the effects of warming. Meanwhile the rich can afford to buy their way out of it and stay comfortable.

Scientists have been busy documenting our changing climate over the past few years and predicting that more adverse weather is to come. They hope to use creative ways to showcase the changes as they happen. As rain clouds gather (no pun intended), policymakers need to unite by vulnerability to the world’s warming and find ways to humanise the climate crisis. Virtually every activity in modern life – growing things, making things, getting around from place to place – involves releasing greenhouse gases, and as time goes on, more people will be living this modern lifestyle. In 2020 disaster struck when a novel virus Covid-19 spread around the world. Because of lockdown measures and economic activities slowed down so much, the world emitted fewer greenhouse gases in 2021 than previous years. The reduction is probably around 5%, and in real terms, that means we release the equivalent of 48-49 billion tonnes of carbon, instead of 51 billion. A meaningful reduction and the world would be in great shape if we could continue that rate of reduction every year. Unfortunately, this is impracticable. Consider what it took to achieve this reduction, millions have lost their lives and many more lost their livelihoods. This is not a situation that anyone would want to repeat. This is evidence that we cannot get to net zero carbon emissions simply by giving up on what we have. Just as we needed new vaccines for Covid-19, we need new tools for fighting climate change: zero-carbon ways to generate electricity, make things, grow food, keep our homes cool and warm, and move people and goods around the world.

“Venture capital has effectively functioned as the gatekeeper to the deployment of capital in the past and is presently seeking cycle-proof investments in more promising and more sustainable opportunities.”

Venture capitalists call for breakthrough ideas, chase innovations and catalyse impacts. Given the focus on long-term, venture capital is mobilised to finance innovations that deliver future needs and fund entrepreneurs who seek to effectively solve current societal problems. The world currently faces an unprecedented combination of compounding high-stake crises: the climate emergency with its increasingly dramatic consequences, the growing concentration of wealth as well as social inequality, and the national political dysfunction that serves as a headwind to overcoming socio-economic malaise. These are E,S,G-related megatrends that define us. Venture capital has effectively functioned as the gatekeeper to the deployment of capital in the past and is presently seeking cycle-proof investments in more promising and more sustainable opportunities. And after events like the Global Financial Crisis and the Covid-19 Crisis, there is a recognition that we need to factor in risks. We cannot let short-term interests affect decisions that will hurt in the long run. There has never been a time of greater promise or of potential peril. The heat is on, and the time is now.

The Environmental criteria evaluates the company as a responsible steward of nature. The Social criteria focuses on how the company manages its relationship with employees, suppliers, customers and the communities in which it operates. Governance refers to how the company manages itself and its operations which includes the company’s internal controls, compensation policies and shareholder rights among others.

With an increasing number of venture capitalist firms jumping on to the ESG bandwagon (e.g. 500 Global, Kinnevik, Gobi Partners), the future of VC is being shaped through ESG. It’s likely a trend that’s going to stay.

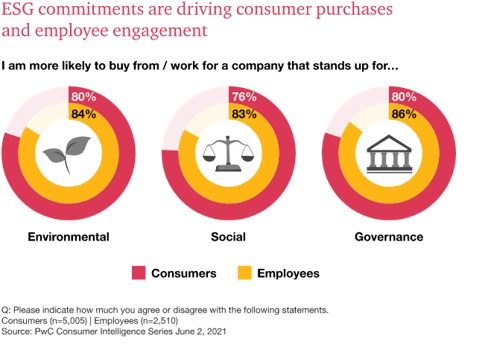

There are a number of reasons as to why VC firms should embrace ESG. First, multiple studies have shown that the neo consumer increasingly care about ethical business practices along with the impact of their consumption on the vulnerable and the planet. This has resulted in a shift in consumer markets, where we see the rise of sustainable fashion, food and the like.

Fourth, from an ecosystem perspective, a focus on ESG fosters a healthy investment chain by starting early-stage companies right. As the business scales, the level of risk associated with poor ESG management also increases and at some point the business will have to treat one or more of its Environmental, Social and/or Governance issues more seriously. Addressing these issues at the early stage with the goal of being “ESG ready” helps to improve the investment ecosystem for future strategic corporate buyers, later stage investors or the public market should the company go public.

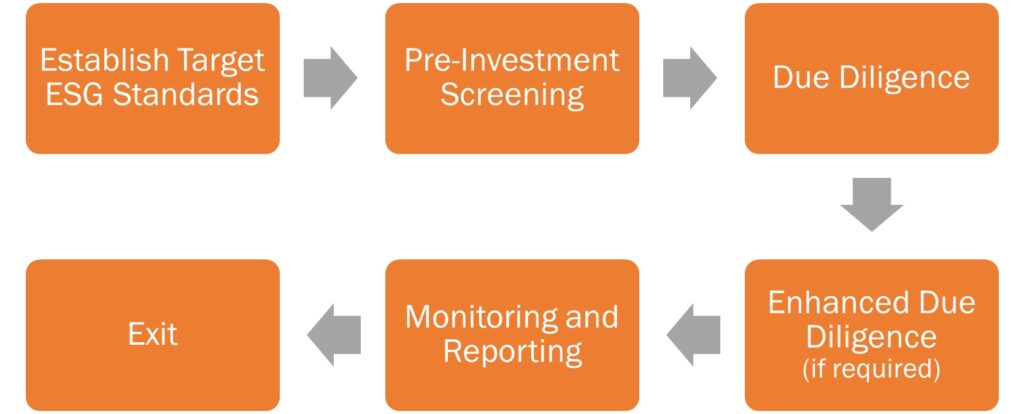

How can a VC get started with ESG?

- Diversity & Inclusion

- Team & Working Environment

- Climate-liked Risk and Environmental Impact

- Supply Chain Considerations

- Data Privacy & Security

- Responsible Product Design & Marketing

- Legal & Regulatory Considerations

- Governance

Please note that these ESG areas should not be limited to the evaluation of investee companies but should be also used as a tool to improve the VC’s own internal operations.

ESG Trends in Private Markets

The topic of ESG has been on the lips of most investors, especially in the public markets. Incorporation of ESG encapsulates the Stakeholder Theory as introduced by Edward Freeman, leading to a more holistic value creation. The private market players, though have been lagging behind, are slowly adopting ESG frameworks and moving towards more sustainable investments.

In the investment fraternity, timing is a vital consideration in decision making: too early, the investments may not yield the best returns; too late, the opportunity is missed. Investors unfortunately do not have the benefit of having the foresight to precisely predict market movements every time. However, a crystal ball is not required to see that VC fund managers who do not incorporate ESG into decision making is at risk of falling behind.

VC Company Spotlight: Molten Ventures plc

How do they evaluate ESG in investments?

Key takeaways from Molten Ventures’ approach is that VC players can and should integrate ESG considerations into investments as the long term benefits far outweighs the costs. In fact, sustainability of investments should be a priority considering the long term nature of this asset class to reduce long term risks associated while enhancing exit returns.

Capital Connections 5.0 – Featuring Eric Feng

More on Eric Feng:

Eric Feng is the Co-Founder and CEO of Cymbal and the General Partner of Gold House. Prior to that, Eric was a partner at Kleiner Perkins investing in cleantech and was also a tech advisor to former Vice President Al Gore. He was previously the founding CTO of Hulu and the founder of social networking site Erly, which was acquired by Airtime.

A summary of our discussion with Eric:

"Venture Capital is the most intellectually rewarding profession that you could possibly be involved with." - Eric Feng -

- Established in February 2021, GetGo’s hourly car rental service makes renting a car hassle-free, affordable and enjoyable. GetGo has a fleet of more than 1,400 vehicles spread across 1,300 locations in Singapore.

- GetGo’s car-sharing business model solves the issue of car affordability while encouraging ESG-friendly practices among its user base. GetGo recently announced that they will be adding around 50 Hyundai electric vehicles (EVs) to its fleet in 2023. GetGo already has a few EV models such as the Hyundai Ioniq EV, Hyundai Kona EV and MG ZS EV on its platform.

- GetGo also has an arrangement with charge point operator CDG Engie (a JV between transport group ComfortDelGro and French energy firm Engie) which allows GetGo’s users to recharge the cars for free.

| DISCLOSURES AND DISCLAIMER |

This Newsletter is strictly informational and is issued Penjana Kapital Sdn Bhd (“PKSB”) on the basis that it is only for the information of the particular person to whom it was provided. This document may not be copied, reproduced, distributed or published by any recipient for any purpose unless Penjana Kapital Sdn Bhd’s prior written consent is obtained. This newsletter has been prepared for information purposes only and is not intended as an offer to sell or a solicitation to buy any securities, and/or any other product in Public or Private markets. Penjana Kapital Sdn Bhd is not making any recommendation to buy any securities or other product and the information provided should not be taken as investment advice.

It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Penjana Kapital Sdn Bhd has no obligation to update its opinion or the information in this newsletter and Penjana Kapital Sdn Bhd recommends that you independently evaluate particular investments and strategies and seek the advice of a financial adviser prior to entering into any transaction. The appropriateness of a particular investment or strategy will depend on your individual circumstances and objectives. The information herein was obtained or derived from sources that Penjana Kapital Sdn Bhd believes are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions and estimates included in this newsletter constitute our views as of this date and are subject to change without notice.

Penjana Kapital Sdn Bhd is not acting as your advisor and does not owe any fiduciary duties to you in connection with this newsletter and no reliance may be placed on Penjana Kapital Sdn Bhd for advice or recommendations of any sort. Nothing in this newsletter shall constitute legal, accounting or tax advice, or a representation that any transaction or investment is appropriate for you taking into account your investment objectives, financial situation and particular needs, or otherwise constitutes any such advice to you. Penjana Kapital Sdn Bhd makes no representations or warranties, express or implied, with respect to the accuracy of the information or fitness for any particular purpose and does not accept any liability (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) for any use you or your advisors make of the contents of this newsletter or for any loss that may arise from the use of this newsletter or reliance by any person upon such information or opinions provided in the newsletter. This newsletter has been prepared by the analysts of Penjana Kapital Sdn Bhd. Facts and views presented in this newsletter may not reflect the views of or information known to other business units within Penjana Kapital Sdn Bhd. This information herein is not intended to constitute “research” as it is defined by applicable laws. This newsletter is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information provided in this document has been obtained or derived from sources believed to be reliable. Penjana Kapital Sdn Bhd does not guarantee its accuracy or completeness and does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinion. Such information or opinions are subject to change without notice, are for general information only and is not intended as an offer to sell or a recommendation/ solicitation to buy any securities, foreign exchange or other product.