Penjana Kapital, in collaboration with Venture University, launches Malaysia’s first venture capital senior executive talent development programme.

Penjana Kapital and Venture University are collaborating to launch Malaysia’s first venture capital (“VC”) senior executive talent development programme targeted at mid-level professionals, KapitalX2. The programme is also supported by Crewstone International, Malaysia Digital Economy Corporation (“MDEC”) and Malaysian Venture Capital & Private Equity Association (“MVCA”).

The programme is a continuation of the first programme, KapitalX, in collaboration with Sunway iLabs which had concluded in November 2022 that focused on juniors and fresh graduates. 32 KapitalX participants had successfully completed the programme upon undergoing a 5-week classroom training and a 1-month venture fellowship with 14 venture capital management companies. The KapitalX programme is Penjana Kapital’s flagship talent development programme established to develop VC talents with the competencies to be world-class investors.

To be launched on 10 July 2023, KapitalX2 aims to equip participants, comprising of experienced entrepreneurs and finance professionals, with a detailed overview of the VC ecosystem, including real-time practical application and networking opportunities. The programme aims to create a robust pipeline of mid to senior-level talents that boosts the VC ecosystem in Malaysia. This is aligned with Penjana Kapital’s objective of building the Malaysian VC ecosystem, as part of the Malaysian government’s initiative to accelerate the development of a future innovation economy.

This 4-month programme is an industry agnostic course that is open to (i) experienced entrepreneurs who have built a start-up, who are also keen on investing in other start-ups as a VC fund manager, and (ii) senior investment professionals with investment management experience in one or more asset classes (i.e., Equity, Fixed Income, Private Equity (“PE”), VC), who are keen on managing a VC investment fund.

“The KapitalX2 programme will ensure we create a consistent pipeline of VC talent, and complements Penjana Kapital’s public-private co-investment programme that seeks to crowd-in private capital, managed by private sector VC firms in the country. A VC industry that is sustainable can only be built if we can simultaneously address both human capital and financial capital shortage gaps. As more funding – both public and private – flows into VC, the industry needs an even bigger talent pool.” said Taufiq Iskandar, Chief Executive Officer of Penjana Kapital.

30 carefully chosen participants will be selected from a pool of applicants for the programme. The programme includes over 60+ hours of course work, including a two-week VC Masterclass and Advanced VC Modules, as well as Startup Pitches and weekly Fireside Chats. Participants will learn the fundamentals of the VC world from Venture University’s management team alongside a highly curated panel of local industry professionals. Learnings include deal sourcing, due diligence, financial modelling, investment term sheets and documents, valuation, cap tables, waterfall analysis, M&A / IPO, raising a VC fund, Corporate VC, managing a Board of Directors, etc. The programme will conclude with a internal reverse demo day on the final week where participants will present their investment recommendations and compete for awards presented during a graduation ceremony.

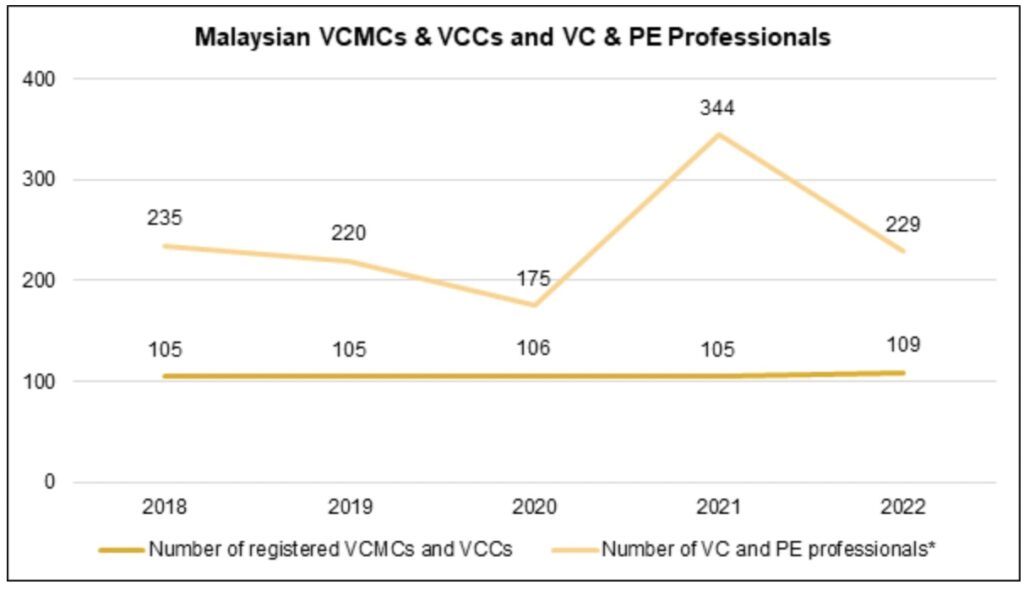

*Professionals with more than 4 years’ experience

Source: Securities Commission Annual Report

In 2022, the number of VC and PE professionals in Malaysia declined by 33% year-on-year to 229 from 344. This is after an impressive growth of 97% in 2021, which coincided with the strong performance and liquidity in the VC space. Furthermore, comparing with other developed VC markets, Malaysia still lacks sufficient VC professionals in order to have a vibrant VC space.

“Crewstone International is excited to support the launch of KapitalX2, Malaysia’s VC talent development programme. We believe in the importance of nurturing and empowering mid-level professionals in the VC ecosystem. Through KapitalX2, we aim to contribute to the growth of Malaysia’s innovation economy by building a strong pipeline of skilled VC professionals. We are proud to collaborate with Penjana Kapital and Venture University to drive the development of the Malaysian VC landscape.” said Izmir Mujab, Chief Executive Officer of Crewstone International.

Chief Executive Officer of MDEC, Ts. Mahadhir Aziz spoke on the collaboration: “This collaboration with Penjana Kapital to run KapitalX2 is a testament of MDEC’s unwavering commitment to provide essential support that is critical to the growth and competitiveness of Malaysia’s digital economy, and its overall contribution to the country’s economic development. Our support is to strengthen our ability to provide mid to senior-level talents with access to networks and resources to help them succeed. Together, we look forward to unlocking new opportunities to develop future VC talent providing participants with the essential skillsets of a Fund Manager and creating a seamless process for investment, innovation, and growth”.

“MVCA is committed to fostering Malaysia’s vibrant and sustainable VC ecosystem. We believe that VC is a key driver of innovation and economic growth, and we support initiatives that align with our mission and objectives. One of these initiatives is to develop and nurture VC talents in Malaysia. The Malaysian government has already put in place some initiatives, including encouraging private sector participation. To make the above a reality, we need to invest more in education and training programmes to equip our VC talent with the necessary knowledge and skills. KapitalX2 is one of the initiatives that can enhance capacity and competitiveness as a VC market in the region, and MVCA is happy to provide support for the programme.” said Ng Sai Kit, Chairman of MVCA.

“We are excited to announce the launch of the Venture Capital Senior Executive Talent Development Programme in Malaysia in collaboration with Penjana Kapital and Crewstone International. This is a great milestone for Venture University as we expand our footprint across the Asia-Pacific region. Malaysia, with its vibrant entrepreneurial spirit and immense potential, stands out as a promising hub for VC. We are fortunate to have the opportunity to support the development of top-tier talent and helping shape the future of the Malaysian VC ecosystem. Together we aim to foster a new generation of leaders who will drive innovation, catalyse growth, and redefine the landscape of VC in Malaysia. We believe that by investing in people, we invest in the future.” – J. Skyler Fernandes, Founder & CEO of Venture University.

This programme is partially-sponsored by Penjana Kapital and Crewstone International. Applications are now open and will close on 5 July 2023. Visit https://www.penjanakapital.com.my/programs/vc-talent-program-2 for the full programme and application details.

END

Mengenai Penjana Kapital

Penjana Kapital ditubuhkan pada 1 Julai 2020 sebagai sebahagian daripada inisiatif Kerajaan Malaysia untuk mempercepat pemulihan ekonomi Malaysia. Ia ditubuhkan untuk mendokong digitalisasi dan automasi perniagaan Malaysia dengan membawa dana dari pelabur antarabangsa dan tempatan ke pasaran modal teroka tempatan.

Untuk maklumat lebih lanjut, sila hubungi:

Penjana Kapital Sdn Bhd

Tel: +603 – 2779 4282

Emel: enquiry@penjanakapital.com.my

About Venture University

Venture University (VU) is the world’s leading investor accelerator for VC, PE, and angel investing. Individuals can choose to participate in two Investor Accelerators: The Venture Capital Investor Accelerator and The Real Estate Private Equity & REIT Investor Accelerator, each includes a robust Education Program (Masterclass, Advanced Modules, Deal Madness, and Fireside Chats) and an Investment Apprenticeship Program to hone their skills in deal sourcing, due diligence, and investment execution across a wide range of sectors. Participants are mentored by seasoned professionals with extensive track records, gain industry networking opportunities, investment experience, and share in the financial upside of the investments made during the program. VU’s senior investment partners have a combined 100+ years of investment experience, deployed over $8.8 billion in VC and real estate, and were some of the earliest and largest investors in over 20 unicorns. VU’s mission is to cultivate diverse global talent and generate superior financial returns for investors, thereby powering a scalable global VC and PE fund and ecosystem. VU’s platform also includes: VU Venture Partneres(a global VC fund), VU Capital Partners (a global PE fund), Bonded Capital (an affininity investor syndicate network), and Finally Fund Admin (an investment admin platform for fund managers and founders).

For further information, please contact:

Venture University

Tel: +603 – 2779 4282

Emel: www.Venture.University

About Crewstone International

Crewstone International is a private equity firm based in Kuala Lumpur, Malaysia. With a primary focus on emerging markets, particularly the ASEAN region, the firm acquires financial equity positions with potential for public listing as well as providing debt instruments to support the growth and expansion plans of businesses in the region. As a selected fund manager under the Dana Penjana Nasional (DPN) programme, Crewstone actively supports foreign investments in Malaysia and serves as a VC partner of Penjana Kapital.

For further information, please contact:

Crewstone International Sdn Bhd

Contact: https://www.crewstoneinternational.com/contact

Website: www.crewstoneinternational.com

About MDEC

MDEC, an agency under the Ministry of Communications and Digital, is at the forefront of driving Malaysia’s digital economy, offering a multitude of support and resources to mid-level professionals through the national strategic initiative, Malaysia Digital (MD). MDEC plays a pivotal role in fostering innovation, empowering entrepreneurs and finance professionals to thrive in a rapidly evolving environment via policy facilitation and various PEMANGKIN programmes.

About MVCA

The Malaysian Venture Capital & Private Equity Association (MVCA) was formed in 1995, to promote and develop the VC and PE industry as well as serve as an authorized platform for members to express their views to policy makers in resolving issues and removing obstacles that impede the growth of the industry.