Most of us probably remember what we were doing on New Year’s Eve in 1999. I was in high school, fretting and waiting to see the countdown to a new millennium, an event that would trigger the infamous Y2K bug. This was the global fear that most hardware programmed only up to the year 2000 would stop functioning then, and lead to computer glitches, power outages and total mayhem in Malaysia and around the world. As we know, it never happened. The Y2K bug was a known unknown so to speak, and every conceivable preparation had been made to make the unknown known.

Entering the year 2020, I was in school once again, completing my third degree and this time in Finance. I thought the new decade would be much more predictable, dealing as it were with known known risks. No doubt dangers looked ahead but the broad risk parameters were relatively clear. Instead, what hit us from out of the blue was an unknown unknown or Black Swan – a term popularised by Nassim Nicholas Taleb – as most recent business jargon has it. The world was affected by Covid-19 spread and it had triggered a global health and economic crisis like no other. However, the tragic irony which has cost millions of lives and affected many livelihoods is that a powerful infectious viral epidemic was a known known – an event long predicted by scientists and for what policymakers and health authorities were long told to prepare.

Against all this health wreckage of the pandemic, the world is seeing unparalleled climate change disasters, diminished social cohesion, and imperfect capitalism. We are still grappling with socio-economic challenges the Covid-19 pandemic has brought, and just as climate change has unleashed monster heatwaves recently, the thunderstorms of populism and unbalanced globalization have wreaked political maelstroms across the world. As geopolitical tension rages on, households across the world face soaring energy and food prices as well as the prospect of prolonged inflation and worsening inequality. And so, the rare so-called Black Swan has become as commonplace as ducks in a pond, and thinking the unthinkable has become common chatter.

"The rare so-called Black Swan has become as commonplace as ducks in a pond…"

There is one single message coming out from the confluence of current crises, and it is that we cannot just have more of the same. And ironically, more of the same includes a concept which was once considered radical, and that is sustainable growth. The fact is being sustainable just will not cut it anymore, because if sustainable means ensuring that the status quo can continue for the long-term, that is not bold enough ambition. Instead of sustainable growth, we need a bolder concept of regenerative growth or development. We have done so much damage to our physical, social, and economic environment, that our country and industries – whatever they are – need to go beyond sustainability and into regeneration. Others have referred to the same idea with the slogan “Build Back Better”, with the emphasis not on just building back, but better.

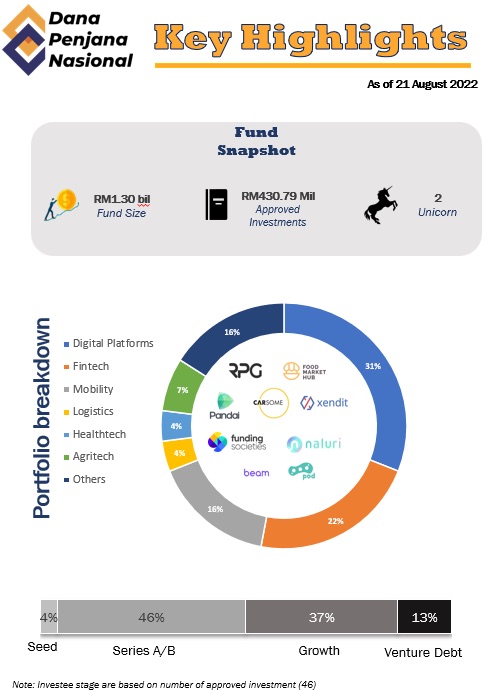

Malaysia too intends to build back its economy. Innovation and entrepreneurship are deemed critical to propel economic competitiveness as well as job and wealth creation. Acknowledging their importance, the Government of Malaysia has turned its focus in the promotion of venture capital market to mobilise innovation and support entrepreneurs. The Government aims to reinvigorate venture capital industry in Malaysia and the country is now in the preconditions phase where it is essential to develop a well-functioning intermediation – diversified number of venture funds and investment professionals as well as investment opportunities. The market is reaching its inflection point. On the supply of capital, the Government has implemented a fund-of-funds programme with matching commitment from Government to encourage broader private sector participation. It has also recently improved tax incentives to encourage investments into venture funds and growth-seeking start-ups. The economics of venture capital are characterised by high risk and high returns, and this requires breadth of risk capital intermediation and availability of complementary financing. As for the demand side, efforts are focused on profiling and branding the country’s offerings as well as building the capacity of local entrepreneurs.

Like most of us, Malaysia has in this most difficult time rediscovered itself and resolved to emerge from these challenges better and stronger than before. As Malaysia celebrates its 65th Independence this month, the country and readers of this newsletter could certainly use a little optimism from the team at Penjana Kapital right now. The team has come out with Why Malaysia issue for the 12th edition of this monthly newsletter.

On that note of hope, I’d leave with this quote from Charles Dicken, written over 150 years ago, and it goes: “It was the best of times; it was the worst of times. It was a season of light; it was a season of darkness. It was a spring of hope; it was a winter of despair.”

"The rare so-called Black Swan has become as commonplace as ducks in a pond…"

ASEAN Outlook

The venture capital industry landscape in the Association of Southeast Asian Nations (“ASEAN”) have exponentially evolved over the last decade. Investors are recognising the acceleration of growth in this region with the increasing digital adoption. Albeit the more cautious stance of investors in recent years, the flow of funds in the region has been very healthy.

Based on the Territory Guide: ASEAN 2022 Report published by Preqin, the 2021 venture capital deal activity in ASEAN skyrocketed recording USD 20 billion, representing a 1.6x increase year on year and doubling the growth of the rest of Asia, with its AUM hitting USD 57 billion as of September 2021. Of the total deals recorded, the majority were in Singapore and Indonesia, which accounted for 46% and 37% respectively.

Malaysia Opportunity

Malaysia is, unfortunately often overlooked by the venture capital and private equity players. Despite the headwinds of the pandemic, geopolitical turmoil, increases in inflation, and interest rates, the country is still on a very stable footing. The potential correction in valuations in the venture capital space as a follow-on effect from the correction in the public markets further presents investment opportunities. Even before the corrections, the Malaysian venture capital industry has always been undervalued as compared to its regional peers.

As the dust settles from the unprecedented Covid-19 pandemic, Malaysia’s economy is recovering quickly. There has been positive growth in the last three quarters since June 2021. In fact, the 2Q 2022 GDP growth of Malaysia was at 8.9%, following a growth of 5.0% in 1Q 2022. Despite the external headwinds that could spill over to the economy, Malaysia would still likely hit its target growth of between 5.3% – 6.3% growth in GDP for the year of 2022 as quoted from Bank Negara Malaysia.

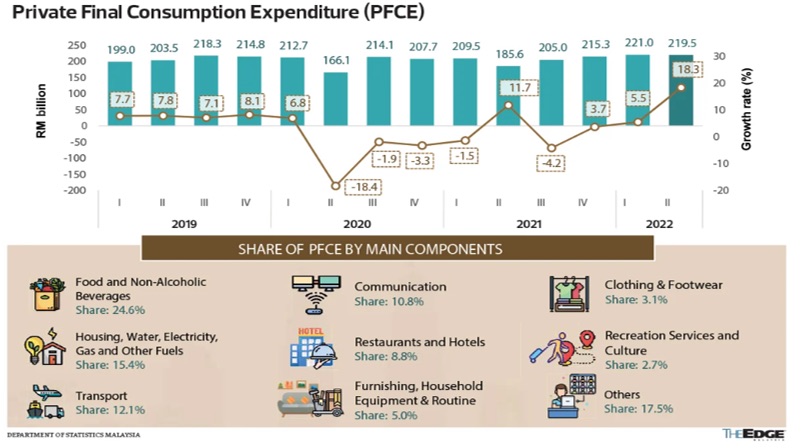

The encouraging GDP growth was fuelled by pent-up domestic demand. The Department of Statistics (DOSM) explained that the expenditure breakdown of the quarterly GDP showed private consumption surging to 18.3% in 2Q2022 compared with only 5.5% in 1Q2022. This spike is driven by the recovery in the labour market and support from policy measures created a spike in private consumption.

The services industry employs 65% of the labour market in Malaysia. With a strong domestic demand, there are opportunities for start-ups and investors looking to invest in B2C and B2B businesses. Agritech, Fintech and Mobility sectors likely will continue to flourish as people are going out and about to spend and travel. In particular, people are spending on necessities and selected discretionary items such as restaurants and hotels, recreational services, and household furnishing which have expanded further during the recent second quarter.

Why Malaysia?

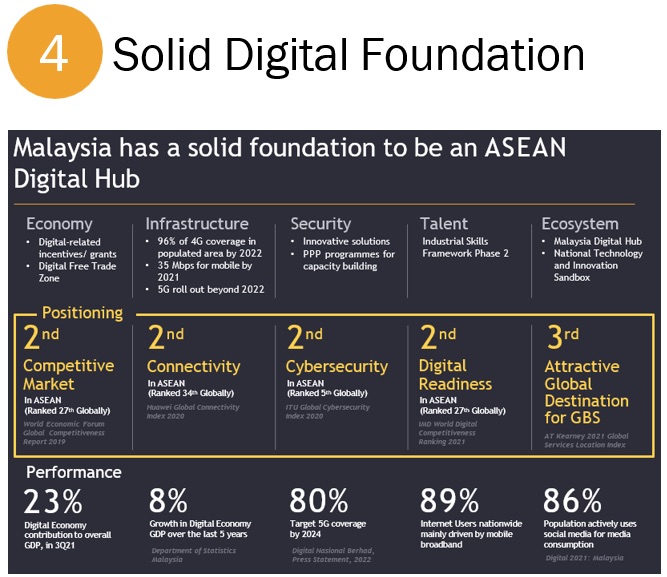

With established physical and digital infrastructures including the deployment of 5G, banking, public transportation as well as aviation, Malaysia is an ideal location for the incubation of start-ups, especially in the digital space. On top of the above, the solid digital foundations consisting of digital related incentives/grants, cybersecurity, availability of high skilled talents as well as ecosystem support further strengthen the country’s appeal. Some notable start-ups that have benefitted include the likes of Grab, Carsome, Boost, Teleport, and Aerodyne.

The Government also provides comprehensive support across various agencies in terms of policies, ecosystem development, funding incentives as well as talent development, envisioning the country to become the regional leader in the digital economy as detailed in the Malaysia Digital Economy Blueprint (“MyDigital”). According to MyDigital, the business segment emphasising on, adopting of e-commerce, attracting unicorns, increasing the number of start-ups, and increasing the digital economy’s contribution to GDP. Moreover, as part of Malaysia’s Shared Prosperity Vision 2030, the Government has identified Key Economic Growth Activities (KEGA), which are sectors/economic activities with potential to accelerate Malaysia’s future economic development.

Malaysia also provides a conducive investment environment for investors with the presence of a mature capital market as well as being the global leader in Islamic banking. The free flow of funds and support provided for foreign direct investments – including portfolio investments, as well as a growing venture capital industry opens the economy for foreign fund flows. The government is also supportive of ESG initiatives which is a focal point of investors in recent times. This illustrates the country’s regional competitiveness, where Malaysia has been consistently ranked favourably in terms of the ease and cost of doing business.

Catalysing Key Economic Growth Areas (KEGA)

As nations in the world are competing to be the best in new economic areas, Malaysia must not fall behind. Malaysia’s economy has been largely built on the traditional economy. There needs to be a focus on emerging industries to ensure the competitiveness of the country as well as insulate it against unforeseen economic catastrophes. Currently, the conventional economic business models have been largely driven by commodity-based trading and low-value products. New Key Economic Growth Areas (“KEGAs”) are key to diversifying the economy and futureproofing it.

To support the new KEGAs, it is imperative that talent transformation take place. Recognizing this, multiple efforts have been undertaken to nurture, upskill and reskill talent to meet the demands of the new KEGAs including the RM1.1 billion allocation for the upskilling and training of 220,000 people in the recent Budget 2022. These efforts should also be complemented by conducive policies that encourage wage appreciation in the labour market. With inflation looming in the distance, real income is in jeopardy. Strengthening the labour market would also mean necessary activities are undertaken to compensate workers according to productivity. With higher wages, workers are able to earn more, and increasing their standard of living. This is a strong pull factor and makes the workforce more attractive.

In efforts to catalysing new KEGAs, there is also a need for growth funding to achieve the aspiration of the government to create new economic sectors for the country. In the spirit of this, we have organised our inaugural Ad-Venture Capital event to showcase the opportunity sets available in Malaysia. We want to champion our local scene and build confidence amongst investors. Hopefully through a better awareness of the growth opportunities in Malaysia, foreign investors especially growth funders would snap up the chance to back the hidden gem that is Malaysia.

Malaysia has 4 key strengths

On 11 and 12 August 2022, Penjana Kapital hosted our inaugural VC Road Show called Ad-Venture Capital 2022 where we hosted regulators, Government officials, and capital market players from local and abroad to discuss and ideate on what Malaysia can offer investors and start-ups in order to create a vibrant capital market ecosystem.

Over the two-day period, various roundtables and discussions were held at Securities Commission Malaysia, Prime Minister’s Office and Bursa Malaysia where we were graced by the presence of Malaysia Minister of Finance YB Senator Datuk Seri Utama Tengku Zafrul Aziz, SC Chairman Dato’ Seri Dr. Awang Adek Hussin, Bursa CEO Datuk Umar Swift and Economic Advisor to the Prime Minister Shahril Hamdan.

VC Discussion – Macro & Market at Securities Commission Malaysia

Fireside Chat with Shahril Hamdan at the Prime Minister’s Office, Putrajaya

Session with Bursa Malaysia

Capital Connections 6.0 – Food Tech

In conjunction with Penjana Kapital’s inaugural Ad-Venture Capital 2022, we had our 6th installation of Capital Connections on 12th August 2022. This time around, the theme for the event was Food Tech. The event was held at Asia School of business, our co-host and in collaboration with Markaids. It was our biggest event to date! In attendance was the Deputy Secretary General of Treasury (Investment), YBrs. Puan Anis Rizana binti Mohd Zainudin together with over 60 participants from regulators, Government officials, and capital market players from local and abroad. Judging from the participants’ feedback, I think it is safe to say that the event was a success!

Panel Discussion – “Market Sizing – The Future of Foodtech“

Capital Connection 6.0 started off with a panel discussion titled “Market Sizing – The Future of Foodtech”, where we featured well-known panellists from the industry such as Patrick Vizzone (Franklin Templeton Global Private Equity), Anthony Siau (Kairos Capital), Dato’ Dr Hartini Zainudin (Yayasan Chow Kit) and Kasey Leong (Markaids). It was a fruitful discussion as the panellist shared facts and personal experiences, expressed their opinions, and answered audience questions.

Meet the Startups: Demo Day

As a staple program of Capital Connections, Penjana Kapital invited eight food tech start-ups from three different genres: “Wellness in Food”, “Alternative Food”, and “Food Production & Supply Chain” to pitch their business and strategies for the future.

Wellness in Food

In recent years, beverages and food that consider the consumer’s desire for well-being and growing health awareness have been prevalent. The focus is on products that, through their formulation and ingredients used, can contribute to a healthy lifestyle in different ways and meet consumers’ personal needs for a balanced and individually supportive diet.

PurelyB

PurelyB is Asia’s leading health and wellness lifestyle brand & community platform dedicated to transforming people’s health and empowering sustainable healthy living. To date, they have amassed over 6 million users across 8+ countries!

Through their platform, a one-stop health solution, PurelyB offer holistic guidance on improving well-being, where users can find nutrition, food recipe, mental wellness, and fitness articles. Not only that, PurelyB has its product line of traditional Asian remedies, such as Pegaga and Tiger Milk Mushroom, which are available on its marketplace for health and wellness products.

Pop Meals

Pop is building Asia’s leading food brands through a network of cloud kitchens and tech-enabled quick service restaurant (QSR) outlets serving and delivering meals created through data-driven product development. It applies artificial intelligence to last-mile delivery, offering the lowest delivery costs in the industry.

Pop Meals have served more than 4,000,000 meals, and 95% of its customers would order again from their platform. The price of their meals ranges from RM10.99 to RM23.99 as of now.

Food Production & Supply Chain

The food supply chain or food system refers to the processes that describe how food from a farm ends up on our tables. The processes include production, processing, distribution, consumption, and disposal.

Food Market Hub

Founded in 2017, Food Market Hub (FMH) is a procurement and inventory management solution for F&B operators. F&B operators can purchase on FMH’s marketplace or from its suppliers, of which FMH’s inventory management system can capture the transaction.

Through its platform, FMH seeks to help F&B businesses to minimize wastage while managing food costs and inventory more efficiently. As of June 2022, the startup has processed over USD 840 million in Total Order Value while maintaining a paid customer retention rate of 88%.

Fefifo

Fefifo is a technology-first co-farming company focusing on digitalising and standardising smallholder farming using its proprietary technology.

Fefifo provides value chain solution to Agroprenueur such as Ready-to-farm spaces, working capital support, proprietary Seed-to-Sale Platform, and guaranteed harvest off-take. Agroprenueur that uses Fefifo’s co-farm could expect to net approx. RM50k-RM70k per min crop plot per year in profits.

Bioloop

BioLoop is a biotech company that revolutionises organic waste management by producing sustainable insect protein for animals and manufacturing natural fertiliser.

Bioloop uses Black Soldier Fly Larvae (BSFL) to break down organic substrates and return nutrients to the soil. On average, a black soldier fly larva will consume twice its body mass daily.

Bioloop offers BSFL as animal feed as it contains a superior peptide profile, resulting in healthier livestock. Bioloop also turns BSFL excrement into Biofertilizer by mixing it with Microbes to boost its nutrients.

Alternative Food

Alternative food is defined as food that is a healthier alternative to food that is prepared or produced by conventional methods. Here are three Start-ups that seek to take a bite out of the Plant-based food market, which is valued at USD 29.4 billion in the year 2020 (Source: Bloomberg)

Phuture Foods

Phuture Foods is a Malaysian plant-based alternative protein company that redefines the future of food with various plant-based meat for the Asian Market. Their products are made to promote food sustainability & security, environmental awareness, cruelty-free, and healthy living.

Since the start of 2022, Phuture has seen a growth of 7x to date. Phuture also targets to reach more than 20,000 locations by Q2 2023 in South-eat Asia. Leading the charge is their high-fibre chicken, as it is an affordable, accessible and versatile type of protein.

Nanka

Nanka is a Malaysian food technology company that creates alternative meat based on young jackfruit pulp to gain considerable market share in both the hybrid and plant-based meat industries.

The idea is to offer consumers a high-fibre alternative to 100% meat products, with all of their patties—vegan or not—boasting anywhere between 8 to 10 grams of plant-based dietary fibre per serving. The brand says it’s directly addressing the gap between the recommended fibre intake of 20 to 30 grams daily and the mere 10 to 15 grams in the average Malaysian diet.

Snappea

Founded in 2020, Snappea is a Malaysian brand of milk made out of peas which contains more protein and is more sustainable than dairy milk. Less than a year after, it was introduced across several countries in South-East Asia and is still expanding into more exciting markets! Today, you can find Snappea’s Pea Milk in over 1,000 retail outlets, such as 7-Eleven, Jaya Grocer, Aeon and many more.

Snappea’s Pea Milks are made from 100% Non-GMO Canadian Yellow Peas, a good source of plant-based protein and one of the most sustainable food sources in the world. Snappea products are high in protein, lactose-free, soy-free and gluten-free.

Dear readers around the world, we want to thank you for following us on this journey. Its been fun and exciting. Let me share with you a bit more about how we started and the journey and what is next. One year ago, the only few people who know about The Kapitalist Monthly were our DPN GPs and a tiny few in our network. Fast forward to today, we got over 2k views on our LinkedIn posts and over 200 subscribers. I have to admit it was not easy choosing the topic on what to write and people internally said this is a waste of time as we were not attracting much readers when we started. Thankfully we prevail and from the bottom of our hearts, we are glad that you are along with us for the ride. We are only getting started, more to come!

| DISCLOSURES AND DISCLAIMER |

This Newsletter is strictly informational and is issued Penjana Kapital Sdn Bhd (“PKSB”) on the basis that it is only for the information of the particular person to whom it was provided. This document may not be copied, reproduced, distributed or published by any recipient for any purpose unless Penjana Kapital Sdn Bhd’s prior written consent is obtained. This newsletter has been prepared for information purposes only and is not intended as an offer to sell or a solicitation to buy any securities, and/or any other product in Public or Private markets. Penjana Kapital Sdn Bhd is not making any recommendation to buy any securities or other product and the information provided should not be taken as investment advice.

It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Penjana Kapital Sdn Bhd has no obligation to update its opinion or the information in this newsletter and Penjana Kapital Sdn Bhd recommends that you independently evaluate particular investments and strategies and seek the advice of a financial adviser prior to entering into any transaction. The appropriateness of a particular investment or strategy will depend on your individual circumstances and objectives. The information herein was obtained or derived from sources that Penjana Kapital Sdn Bhd believes are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions and estimates included in this newsletter constitute our views as of this date and are subject to change without notice.

Penjana Kapital Sdn Bhd is not acting as your advisor and does not owe any fiduciary duties to you in connection with this newsletter and no reliance may be placed on Penjana Kapital Sdn Bhd for advice or recommendations of any sort. Nothing in this newsletter shall constitute legal, accounting or tax advice, or a representation that any transaction or investment is appropriate for you taking into account your investment objectives, financial situation and particular needs, or otherwise constitutes any such advice to you. Penjana Kapital Sdn Bhd makes no representations or warranties, express or implied, with respect to the accuracy of the information or fitness for any particular purpose and does not accept any liability (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) for any use you or your advisors make of the contents of this newsletter or for any loss that may arise from the use of this newsletter or reliance by any person upon such information or opinions provided in the newsletter. This newsletter has been prepared by the analysts of Penjana Kapital Sdn Bhd. Facts and views presented in this newsletter may not reflect the views of or information known to other business units within Penjana Kapital Sdn Bhd. This information herein is not intended to constitute “research” as it is defined by applicable laws. This newsletter is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information provided in this document has been obtained or derived from sources believed to be reliable. Penjana Kapital Sdn Bhd does not guarantee its accuracy or completeness and does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinion. Such information or opinions are subject to change without notice, are for general information only and is not intended as an offer to sell or a recommendation/ solicitation to buy any securities, foreign exchange or other product.